what percentage of taxes are taken out of paycheck in nc

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were. 10 12 22 24 32 35 and 37.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

. North Carolina moved to a flat income tax beginning with tax year 2014. However they dont include all taxes related to payroll. For tax year 2021 all taxpayers pay a flat rate of 525.

Minimum Wage in North Carolina in 2021. FICA taxes consist of Social Security and Medicare taxes. 10 percent 12 percent 22 percent 24 percent 32.

Divide this number by the gross pay to determine the percentage of taxes taken out of a. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Each employers payroll for the last three fiscal years as of July 31 of the current year.

For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. No state-level payroll tax. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is.

Just enter the wages tax withholdings and other information required. To use the calculator. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

Take Your 2019 Standard Deduction. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. Hourly non-exempt employees must be paid time and a.

The median household income is 52752 2017. The amount of taxes to be. North Carolina has a 475 percent.

What percent is tax in North Carolina. Raleigh NC 27609 Map It. That rate applies to taxable.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. What is the percentage of federal taxes taken out of a paycheck 2020. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

Based on economic conditions an employers tax rate could be as low as 0060 or as high as 5760. North Carolina Income Taxes. The income tax is a flat rate of 499.

North Carolina Withholding Tax State Income Tax With a North Carolina state personal income tax rate of a flat 499 for 2022 employees pay this tax with paycheck withholdings. It is not a substitute for the advice of an accountant or other tax professional. The federal income tax has seven tax rates for 2020.

Social Security Tax. FICA taxes are commonly called the payroll tax. What percentage of my paycheck is withheld for federal tax 2021.

The federal withholding tax has seven rates for 2021. The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

North Carolina Payroll Tools Tax Rates And Resources Paycheckcity

New Tax Code Impacts Lottery Prizes

Aia Architect Salary In Durham Nc Comparably

North Carolina Paycheck Paystub Calculator Paycheck Stub Online

Salary Paycheck Calculator Calculate Net Income Adp

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

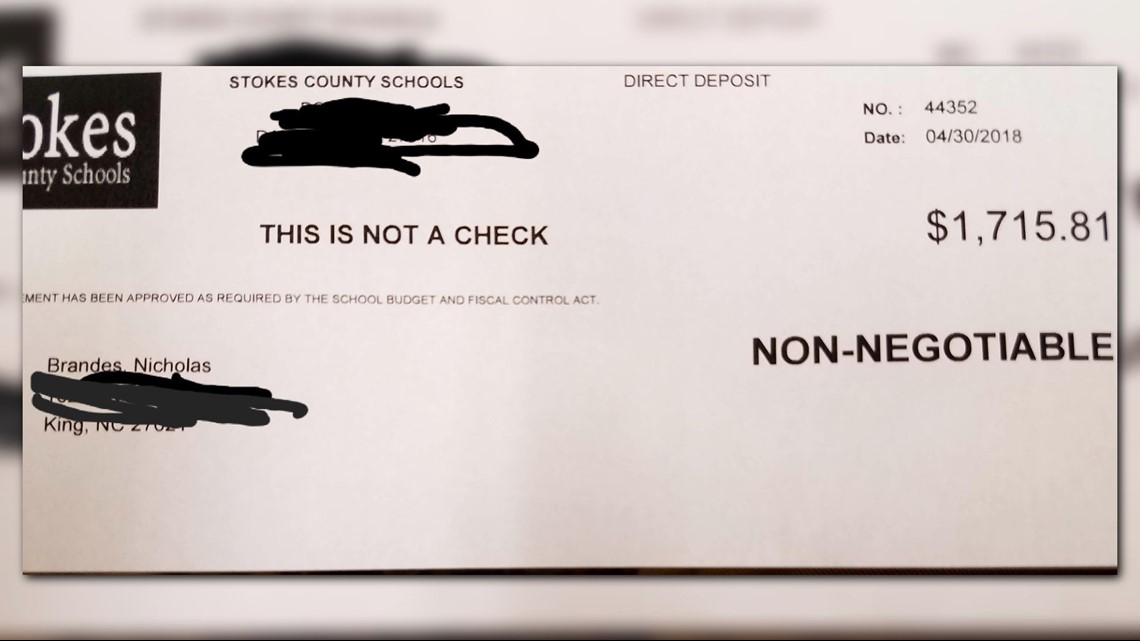

I M Paid 53 A Day To Educate Your Child Nc Teacher Posts Copy Of Paycheck Wcnc Com

Nc Budget Allows Ppp Deductions Reduces Tax Rates More

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Politifact Nc Teacher Says I Make 53 Per Day Records Show He S Wrong Abc11 Raleigh Durham

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

How To Do Payroll In North Carolina Detailed Guide For Employers

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

N C Tax Code Taxing Even For Experts

How Much Taxes Deducted From My Paycheck N C

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Salary Paycheck Calculator Calculate Net Income Adp

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator